By resolving these discrepancies, you ensure that the company’s financial records accurately reflect its true financial position. In addition to managing accounts receivable, full charge bookkeepers are responsible for handling accounts payable. This involves keeping track of all outgoing payments to suppliers, vendors, and other creditors. By maintaining accurate records of these transactions, you ensure that all expenses are properly recorded and accounted for. In summary, a full charge bookkeeper has a range of career advancement opportunities available.

Full Charge Bookkeeper vs. Regular Bookkeeper

By embracing automation and leveraging technology, full charge bookkeepers can enhance their efficiency and accuracy. Outsourcing bookkeeping services offers businesses the opportunity to focus on their core functions while benefiting from specialized expertise. The rising demand for full charge bookkeepers in small businesses underscores the of maintaining accurate financial records and gaining valuable financial insights. As the industry continues to evolve, full charge bookkeepers must stay abreast of these trends to remain competitive and provide exceptional services to their clients. In summary, being a proficient full charge bookkeeper requires a combination of technical skills and personal qualities. By possessing these skills, you can effectively contribute to the financial success of the business you work for.

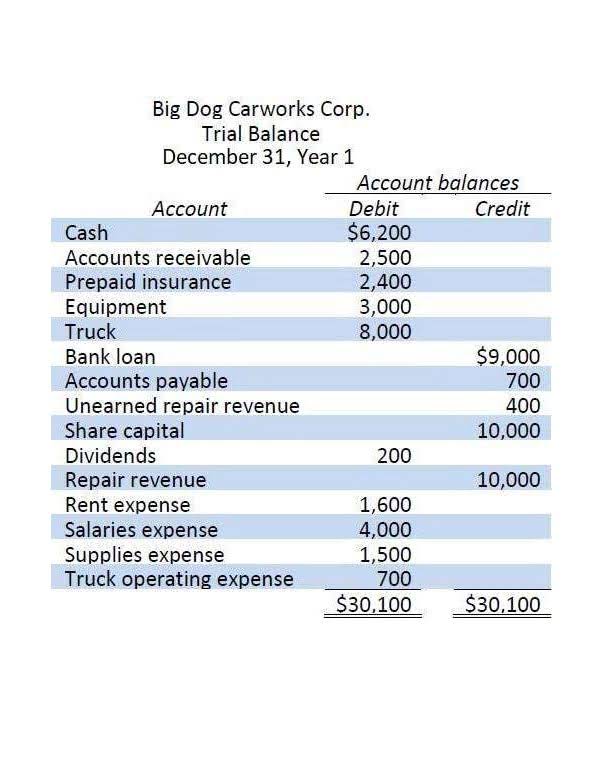

- The full charge bookkeeper analyzes the trial balance and makes any necessary adjusting journal entries to correct discrepancies, notes Solution Scout.

- We are looking for a detail-oriented Full Charge Bookkeeper to manage all financial transactions, from fixed payments and variable expenses to bank deposits and budgets.

- Full charge bookkeepers are often employed by small to medium-sized businesses or may work as independent contractors.

- By ensuring the accuracy of financial data, full-charge bookkeepers provide business owners and management with a clear view of the organization’s financial position and cash flow.

- These bookkeepers are responsible for overseeing the company’s day-to-day financial operations and ensuring that everything from payroll to receivables is handled in a timely manner.

Full Charge Bookkeeper Job Description FAQs

- We’re looking for a Full Charge Bookkeeper to manage all aspects of our financial records, from Accounts Receivable and Accounts Payable to Payroll and General Ledger.

- With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

- Vyde is a licensed accounting firm (CPA) based in Provo, Utah, and members of the AICPA.

- This job may require sitting or standing for extended periods of time, as well as some light lifting.

They help record complex transactions and process timesheets & payroll while ensuring compliance with all regulations and relevant laws by reporting to the firm’s senior manager. Proficiency is https://www.bookstime.com/ fundamental for full charge bookkeepers who manage all the accounting work done in a company. This knowledge affects the consistency and accuracy of financial statements and other reports.

Importance in Business

In the office environment, you will have a designated workspace equipped with a computer, accounting software, and other necessary tools. This allows you to carry out your bookkeeping duties, such as managing accounts payable and receivable, maintaining the general ledger, and reconciling bank statements. With the availability what is a full charge bookkeeper of these resources, you can easily access financial records, analyze data, and generate reports. One of the most important skills for a full charge bookkeeper is proficiency in accounting software. In today’s digital age, bookkeeping tasks are largely automated, and being well-versed in accounting software is essential.

Qualifications and Experience

Some Full Charge Bookkeepers also manage a company’s cash flow, maintaining a close eye on credits and debits to ensure the company remains financially sound. Their role often extends to budgeting and financial forecasting, where they analyze financial data to provide insights on business performance and guide future financial decisions. A full-charge bookkeeper is usually assigned more responsibilities, and performs a more complex role than a regular bookkeeper, especially in a small business.

Additionally, outsourcing bookkeeping services provides access to specialized expertise. Full charge bookkeepers who work for outsourcing firms are well-versed in the latest accounting practices and regulations. They can offer valuable insights and recommendations to optimize financial processes and ensure compliance with industry standards.

Transitioning from Traditional Bookkeeping